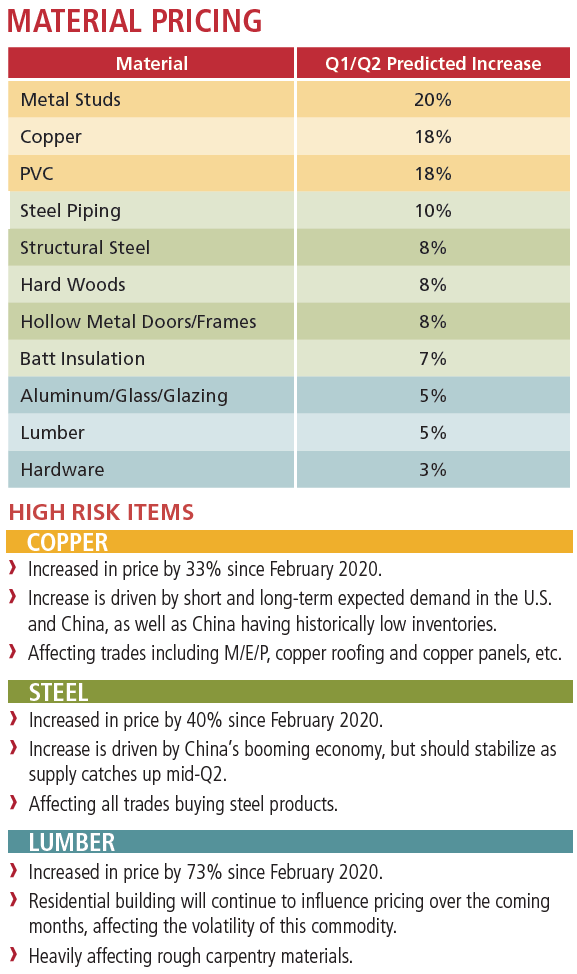

To help our partners plan throughout 2021, our team continues to collect data across all markets, from New England to the Mid-Atlantic, to forecast market trends, prices and schedule impacts. Overall, this year, we continue to see material prices rise especially in metals, while the pandemic has forced subcontractors to embrace more technology to pre-fabricate and utilize design-assist more often to improve speed-to-market.

2021 Market Outlook: Material and Labor Supply Update

Insight from Peter Capone, Consigli’s Director of Purchasing

EVOLVING TRENDS

TECHNOLOGY ADVANCEMENT

TECHNOLOGY ADVANCEMENT

The pandemic has motivated subcontractors and vendors to implement technological advancements into their shop and field processes. Cost saving material management software, tool upgrades and robotics are improving efficiencies which is allowing subcontractors the flexibility in managing on-site workforce restrictions.

PRE-FABRICATION

PRE-FABRICATION

Surveyed participants are pre-fabricating 20%more than before the pandemic, assisting in managing workforce requirements in the field.

DESIGN-ASSIST

DESIGN-ASSIST

71% of our respondents noticed an increase in requests for design-assist proposals which further confirms the need for speed-to-market becoming a priority of many clients. Ensuring the construction manager has a defined process for properly implementing this approach will benefit project schedules. Vetting subcontractors for similar project experience, backlog capacity and financial wherewithal should be a focus.

WORKFORCE RESOURCES

72% of the surveyed subcontractors are not concerned with staffing projects in 2021. Based on work in the pipeline, we should continue to monitor workforce resources for 2022.

RECOMMENDATIONS

- Continue to keep a close eye on high risk materials.

- Lock in subcontractor pricing as soon as possible to avoid future price escalation.

- Hold contingencies for material escalation in estimates and budgets to avoid exposure.

- Watch for supply chain disruptions from products sourced overseas. We continue to receive delay notifications for products

such as flooring, cabinetry, etc. so we suggest procuring from domestic vendors when possible. - Identify long-lead materials and ask subcontractor and vendors about alternate materials and options.

To access a full PDF of this information, click here:

2021 Market Outlook_Material and Labor Supply Update