Due to the prolonged effect of COVID-19, we continue to collect information from our subcontractors and vendors in an effort to forecast price and schedule impacts to our industry. The following is a summary based on surveys from a solicited group of 200+ subcontractors and vendors in the Northeast. The group was asked to provide their predictions for potential price increases for the next six months.

COVID-19 Impact: Material & Labor Supply Update

Insight from Peter Capone, Consigli’s Director of Purchasing

The overall feedback implied market risk is subject to certain trades, but bid coverage is high and pricing is aggressive, indicating it is an ideal time to procure subcontractors for upcoming projects.

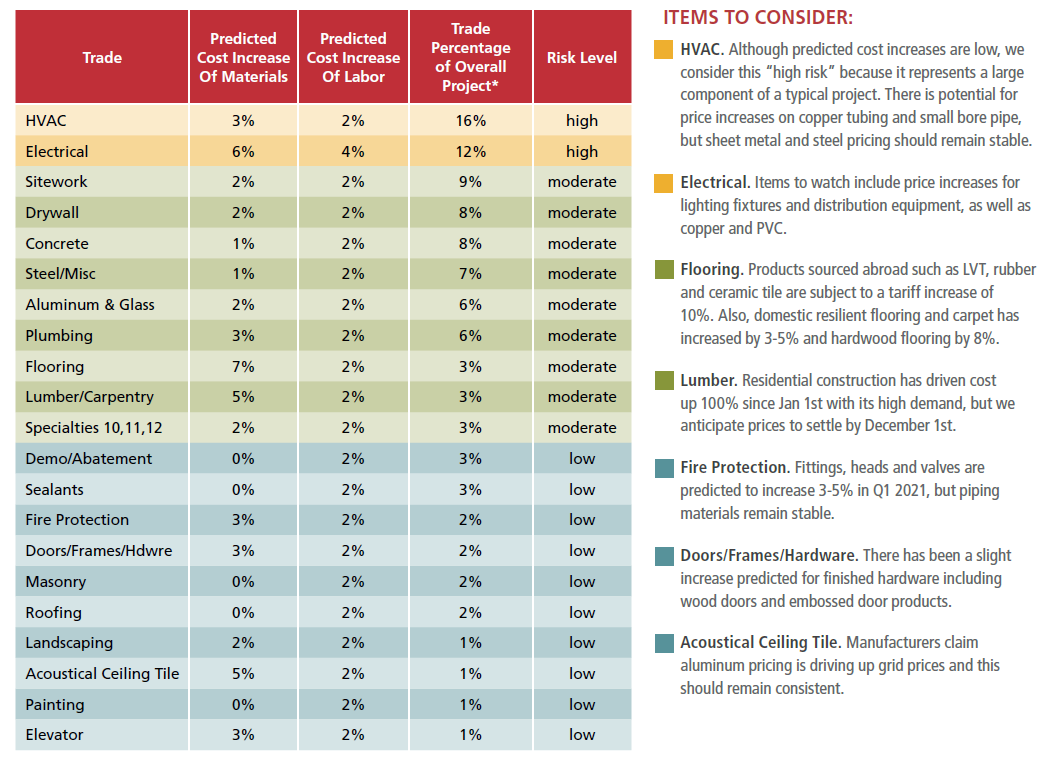

MATERIALS & LABOR PRICING

*Trade Percentage of Overall Project represents the percent of the trade compared to the overall project. The breakdown percentages were derived using historical data accumulated by Consigli over the years. It is an average of all project types, including new construction, renovations and other niche project types. Therefore, when using this chart to apply to a specific project, it is important to understand the project composition.

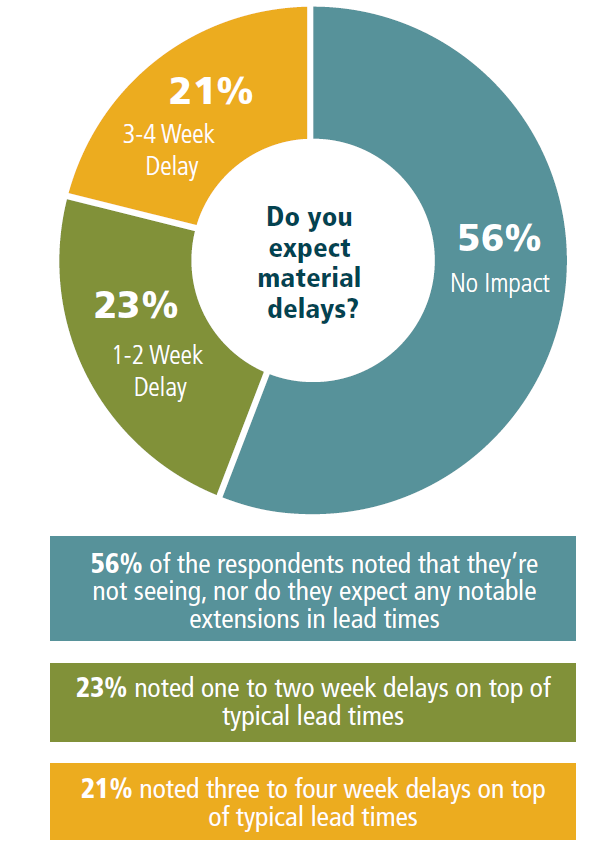

MATERIAL LEAD TIMES

According to our survey, about half of the subcontractors reported no major increase in lead times. The other half have reported slight to moderate increases due to COVID-19. Subcontractors are continuing to place focus on ordering materials as soon as possible to prevent schedule delays.

RISKS TO WATCH FOR:

- Glass & Aluminum. Small to mid-sized regional insulated and float glass suppliers appear to have struggled with COVID-19 and the

result has been weak performance and unreliable deliveries. Delays have been two to four weeks on top of typical lead times. Subcontractors are advising to stick to larger, national manufacturers, in order to ensure schedule compliance.

- Lumber. Demand is high due to several factors in the residential market. The typical “off the shelf” items are now running two to four weeks for delivery. This includes pressure treated materials, kiln dried materials, OSB’s and plywood and structural framing materials. Suppliers should catch up as we move into the winter and residential building slows.

- Distribution & Transportation Issues. Materials typically running four weeks after approvals are now running six to seven weeks for delivery. Suppliers are having distribution and transportation issues with materials sitting on loading docks waiting for trucking companies weeks prior to shipment. This issue appears to be affecting delivery of flooring and other finished products.

- Electrical Lighting/Gear/PVC. Recommend adding three weeks to the typical four week lead time for switchgear and distribution equipment. Also, add four weeks to the typical lighting lead time, which typically varies from six to 12 weeks. PVC lead times have also increased by another two weeks.

- Custom Fabricated Materials. All custom materials sourced domestically or from oversees continue to be an issue. Expect an extension of four to six weeks on top of the typical lead times. This affects all trades, but in particular, HVAC, electrical, plumbing and flooring. When applicable, consider standard products.

LOOKING AHEAD

Now is a good time to finalize estimates, lock in pricing, and move forward with projects.

Compared to last year’s heated market, we are experiencing better than normal bid coverage and aggressive pricing in nearly every trade. Although subcontractors are reporting a healthy backlog, they are actively seeking to book work for 2021 and 2022 due to uncertainty of the future. Also, 93% of the subcontractors surveyed are confident, that if needed, they have the ability to acquire additional staff. They have returned to work and maintain current manpower demands. There is potential when the COVID-19 vaccine is developed, the construction market may start trending back towards pre-COVID-19 levels of activity, increasing the cost of construction. Therefore, now is the time to move forward with upcoming projects.

To access a full PDF of this information, click here:

Covid-19 Impact_Material and Labor Supply Update