The current situation regarding COVID-19 and the supply chain of materials is ever changing.

The information below provides a snap-shot of where we are currently and the outlook on how this will affect our industry.

Market Watch as COVID-19 Evolves

Insight from Peter Capone, Consigli’s Director of Purchasing

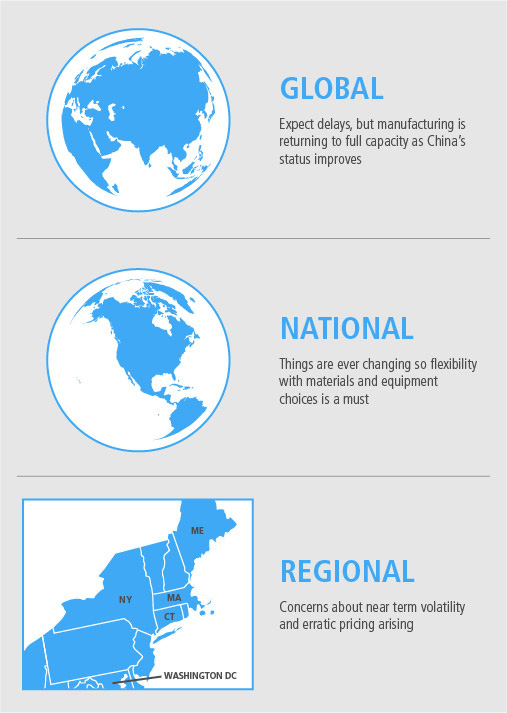

GLOBAL

GLOBAL

As time goes on, it’s becoming apparent that although we will see a lag in supply, China is in the process of recovery, therefore manufacturing has started to return to full capacity.

Constrained logistics, travel restrictions and a shortage of labor in China will most certainly cause some delay, although the slow-down in the construction industry in the United States (U.S.) will provide time for this major supplier of product to recoup.

According to a report from Construction Dive, Chief Economist for Dodge Data & Analytics Richard Branch estimated that 30% of building products in the U.S. are imported from China. While China seems to be slightly rebounding from the disease, its decreased manufacturing output is still expected to impact construction in the United States.

NATIONAL

- The differing State mandates from local governing authorities continue to make tracking the reliability of domestic supply chain a day to day challenge.

- The enforcement of mandatory protocols has caused drops in efficiencies in the manufacturing work force as well as the on-site installation work force. We expect to see these protocols become more stringent “IF” cases of the virus continue to increase. Receipt of Steel and Pre-cast Concrete from Quebec and other parts of Canada is also changing daily as fabricators apply for dispensation. Currently most fabricators are being allowed to deliver to the U.S. That being said, there is rumor that deliveries may be delayed due to driver quarantines.

- Many domestic fabricators in Pennsylvania, New York, Georgia and other states are shutting down and reducing fabrication plant activity, which will delay deliveries of millwork, aluminum windows, brick and now potentially flooring products. As the virus flows through each state, knowing where your materials are coming from, remains exceedingly important.

- Owner’s/Architects should prepare to be more flexible with material/equipment choices depending on schedule and cost risks and priorities.

- Electrical fixtures and Mechanical equipment – although parts and pieces may shortly be available, domestic fabricators will be required to assemble.

- According to analysis done by S&P Global Platt, China’s output of finished steel, a key export in American building projects, was expected to fall by up to 43 million metric tons year-over-year last month due to the Coronavirus outbreak.

- According to an article from Construction Dive on April 2, 2020:

- COVID-19 exposed inefficiencies in the way the U.S. sources materials/merchandise/etc.

- As a result there will be more focus on U.S. manufactured materials

- This could be an opportunity to look at local or U.S.-based pre-fabrication to cut out the international supply chain for materials

REGIONAL

Concerns are rising about near term volatility and erratic pricing as subs scramble to work from home and figure out COVID impacts.

PRECAUTIONARY MEASURES

- Consigli has maintained focus on tracking products. Domestic fabrication is now under the microscope. Communicating with Vendors and understanding “What’s left on the shelf” is of vast importance, as fabrication plants reduce output due to labor reductions.

- We’ve continued to keep a close eye on “over saturation” of Subcontractors and Vendors. Spreading the work to minimize risk while at the same time keeping as many of our partners working, has become a very high priority.

- Early buyout of high dollar, long lead-time packages has remained a priority.

- Awarding packages with an initial commitment for payment of shop drawings and design services, prior to fully committing to material procurement has lessened the risk for all parties.

To access a full PDF of this information, click here:

Material Supply Update_040720