The current situation regarding COVID-19 and its impact on our industry continues to evolve. In an effort to better understand these project impacts we surveyed over 250 trusted subcontractor and vendor partners from across the Northeast, DC, and NY. Below we summarize the trends and key takeaways.

COVID-19 Impacts: Subcontractor and Supplier Survey Results

Insight from Peter Capone, Consigli’s Director of Purchasing

Below we summarize the trends and key takeaways:

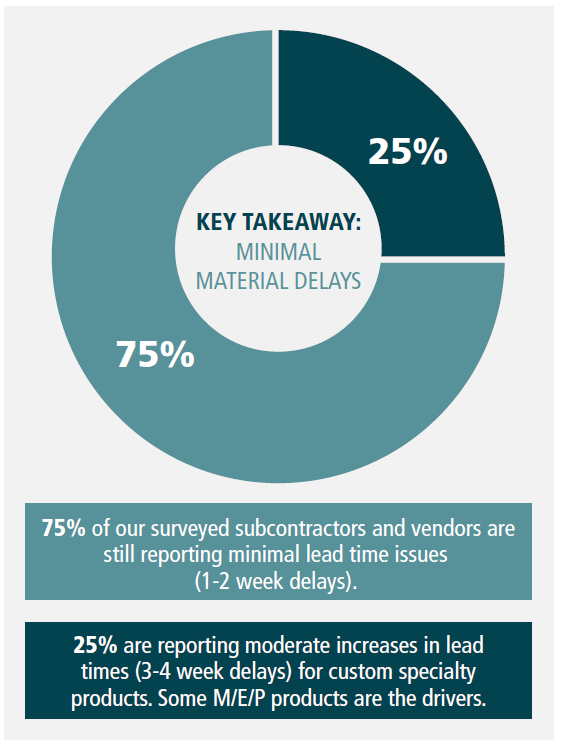

MATERIAL SUPPLY

MATERIAL SUPPLY

ITEMS TO CONSIDER:

- Watch for spikes in pricing. Due to a surge in projects coming back on line, there’s a potential that demand will increase in the short term. This could cause small spikes in pricing and further lengthen predicted delays.

- Shorten supply chain when possible. Eliminate the potential risk of increased shipping costs and potential delays caused by buying from distant suppliers.

- Understand fabricator lead times. Many fabricators have taken advantage of delays and project closures and fabricated everything in their pipeline. Fabricators are eager to begin new projects.

- Prefabrication of materials. Advantages include improved quality, expedited installation schedules, and lowering safety risk in the field. Consigli is currently prefabricating everything from doors preinstalled with hardware, to full bathroom pods in an effort to save time and reduce the number of on-site workers.

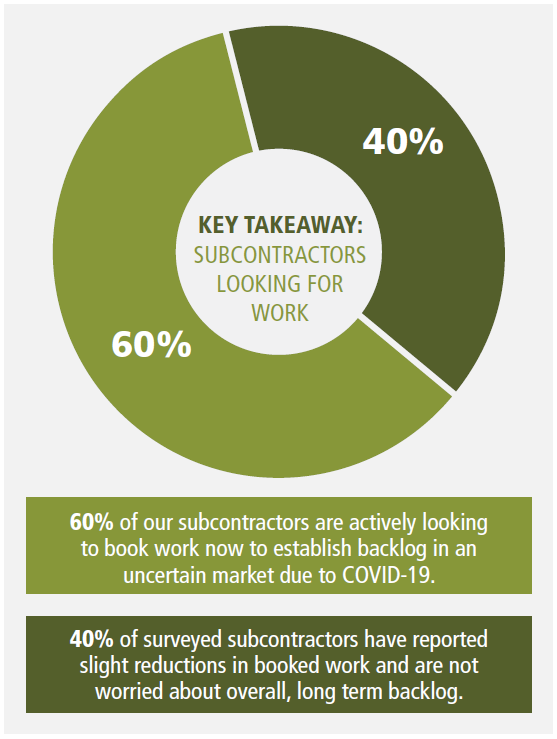

BACKLOG

BACKLOG

ITEMS TO CONSIDER:

- Talent pool availability. Subcontractors are anxious to get key employees back to work. There is an open opportunity to obtain talented teams if subcontractors are provided with immediate opportunities to start work.

- Workload hesitations. Some subcontractors are uneasy about booking new work that coincides with the restarting of existing projects due to a potential heavy workload as they figure out the new guidelines.

- Price reductions only offsetting COVID-19 related costs. There are wide ranging costs from 0-15% due to lost time and inefficiency associated with new protocols that balance out near term price reductions. However, price reductions due to bidder aggression to secure backlog are resulting in reduced overall pricing.

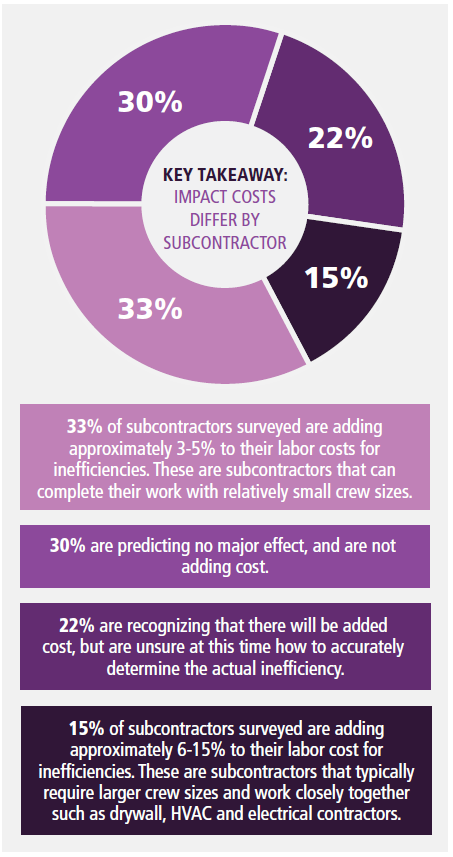

COVID-19 COSTS

ITEMS TO CONSIDER:

- Scheduling is critical. Collaboration with subcontractors to create clear, coordinated work plans can minimize inefficiencies. Staggered start times to control the influx of workers entering sites should be considered. Our teams are working hard with our subcontractor partners to evaluate and mitigate the impacts of each project specific safety plan. These are then being communicated to our clients to help them understand potential costs and risks.

- Scrutinize/control COVID-19 cost. As time goes on, subcontractors are realizing the actual cost impacts of the newly applied safety protocols and procedures. During project buyout, we’re pressing subcontractors to define actual costs based on definable metrics. We are also leveraging trade package awards to eliminate or minimize these costs. COVID-19 related costs are properly defined as breakout or alternate prices, allowing us to revisit and reduce accordingly, if conditions change.

- Crew size and logistics drive cost. Subcontractors required to provide large crews working in close proximity may incur cost due to new protocols and safety requirements. Although the individual cost of these items may be minimal, they add up on large projects. Below are several items that are driving cost:

- PPE materials

- lost time due to testing and reporting

- lost efficiency due to 6’ proximity restrictions

- lost time due to job site logistics, travel restrictions and elevator capacity limits

Working with subcontractors and labor affiliations to stagger work time starts can be a solution and incorporated into contracts to loosen up workforce bottlenecks.

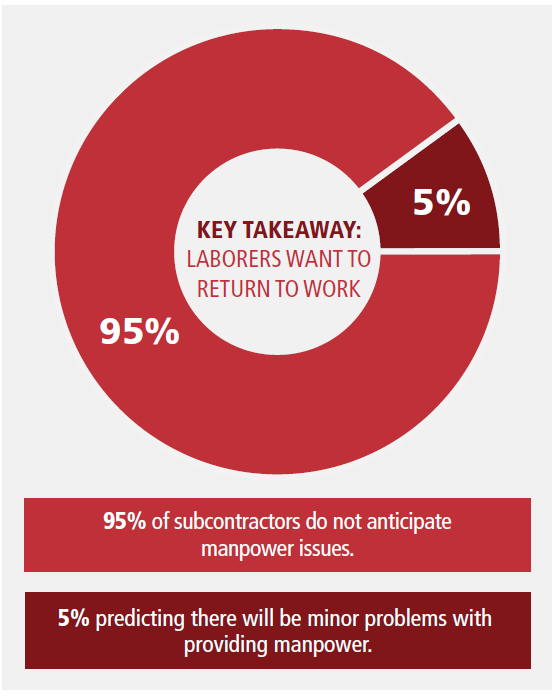

PREDICTED LABOR ISSUES

PREDICTED LABOR ISSUES

ITEMS TO CONSIDER:

- Staffing will be controlled upon return. In the short term as jobs reopen, COVID-19 safety requirements may limit workforce on project sites. Subcontractors are anticipating this will help avoid any spikes in manpower requirements, allowing for a controlled re-staffing plan.

- Stimulus impact. Several subcontractors have mentioned minor concerns over the stimulus package and unemployment benefits lowering motivation of workers to return to work. Percentages range from 5-15% of overall workforce. Some workers may also need to remain home to take care of family members or children.

- Potential trade labor loss. There is a risk that some of the trade labor that was laid off may not return to our industry, similar to past recessions.

This feedback and insight reflects the current situation impacting our industry. This information can be used as a resource as you navigate the recovery phase of COVID-19 and look for creative solutions to stay on track or begin new projects. Being nimble and adaptable as you work through the new environment will be key in progressing forward.

To access a full PDF of this information, click here:

Covid-19 Impact_Subcontractor and Supplier Survey Results_6.12.20